Click here to view the 2025 Inframark Benefits Guidebook

This dedicated page will provide you with important information, tools and resources that you need to help you make informed enrollment decisions in regard to your 2025 plan year benefits. The benefits you select are binding through December 31, 2025.

(click here for the Spanish version)

Health Plan Contributions

! Prescription Insurance Carrier Change

! Life & Disability Insurance Carrier Change

Inframark’s life and disability insurance carrier is changing from Lincoln Financial Group to Prudential. Benefits and plan design will remain the same.

Healthcare Flexible Spending Account (FSA) IRS Annual Limits Increase:

The annual FSA employee contribution limits are increasing from $3,200, to $3,300. You can rollover up to $640 going into 2025.

Health Savings Account (HSA) IRS Annual Limits Increase:

The annual HSA employee contribution limits are increasing to the following limits. Be aware, these do include the Inframark employer contributions ($500 for single; $1,000 for family):

On a desktop of smartphone click the button at the top of this page that says, “CLICK HERE TO ENROLL IN YOUR 2025 INFRAMARK BENEFITS”. You can also enroll on your smartphone via the MyChoice mobile app found on the App Store or Google Play NOTE: New Online Benefits Center users must register first via the website version, then can login to the MyChoice mobile app. Click here to get registered.

Remember, Sofia is your personal Online Benefits Assistant. She can help answer any benefits questions you may have. You can access her directly from your phone, via the Inframark Online Benefits Center or through the MyChoice mobile app.

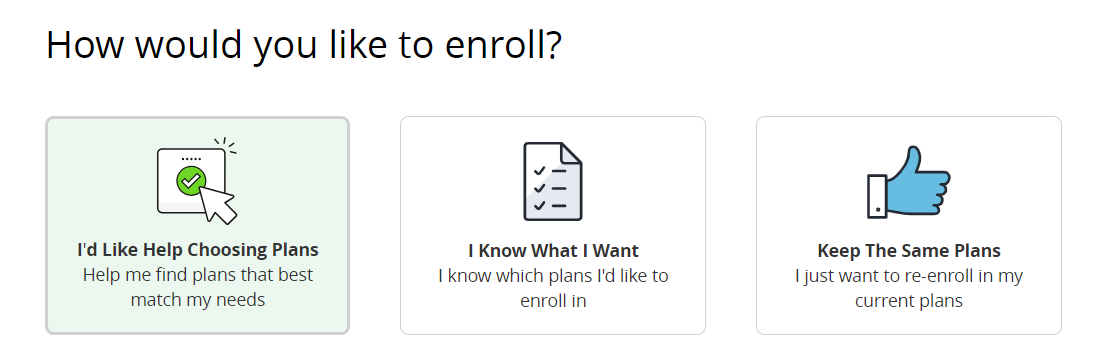

If you need help deciding which benefits are the right fit for you and your covered family members. Know that you have access to a Decision Support Tool that is embedded in the enrollment process.

If you need assistance registering, logging in, enrolling in your benefits, just call the Inframark Online Benefits Center Support Team at 888-532-3617, available Monday – Friday 9am – 6pm EST/ 8am – 5pm CST. If you need assistance beyond the Online Benefits Center, please email benefits@inframark.com.

If you are happy with your current benefit elections, no action is required. Enrollment is passive.

If you want to enroll in benefits for the first time, or make changes, you must make the changes during the Open Enrollment timeframe which takes place 11/6 – 11/20/2024.

! Current Healthcare & Dependent Care FSA Participants: If you want to continue to contribute to an FSA in 2025, you must actively enroll your FSA annual contribution amount. Your current 2024 FSA election will not carry over into 2025 automatically.

Qualifying Life Events: The only time you can make changes outside of open enrollment is if you or a dependent encounter a Qualifying Life Event such as: birth/adoption, marriage/divorce, gain/loss of healthcare coverage, etc. If any of these situations occur, you must report your life event within 31 days of the event occurring via the Inframark Online Benefits Center or through the MyChoice mobile app.

Eligible Dependents: spouse or domestic partner and child(ren). NOTE: You must have all dependents birthdates and social security numbers ready.

! Wellness Program Incentive: Click here for information on how to choose your incentive reward (for participants who met the 150 or 450 wellness points during the 2/1 – 8/31/2024 wellness program).