401(k) Savings Plan

One way to save for your future retirement is to participate in a 401(k) Plan now. Inframark offers employees a 401(k) Savings Plan to help you save for your retirement. The 401(k) Savings Plan is administered by Empower Retirement. The plan enables you to contribute to a tax-deferred savings account to increase your retirement income.

Click here to access the 401(k) enrollment guide.

Watch a quick video on how Inframark’s 401(k) plan works. (video is about 5 min long)

Visit empowermyretirement.com or call 855-756-4738 to enroll, manage your account, or if you have questions.

Key 401(k) plan features:

- 50% company matching on employee contributions up to 6% (net 3% match).

- 5-year graduated vesting on employer contributions (20% per year); a broad array of funds available to diversify your investments.

- You will automatically be enrolled at 6% after 90 days of employment unless you opt-out or connect with Empower to enroll sooner.

- Auto-escalation feature which automatically increases your contribution 1% each year (up to 10%), unless you opt-out.

- You have the option to contribute Pre-tax, Roth, or After-Tax.

- Rollover your retirement savings from another eligible retirement plan.

- For tax year 2025, the maximum elective deferral to a 401(k) plan is $23,500. Employees 50 years old and older can make additional catch-up contributions of up to $7,500.

- For tax year 2026, the maximum elective deferral to a 401(k) plan is $24,500. Employees 50 years old and older can make additional catch-up contributions of up to $8,000.

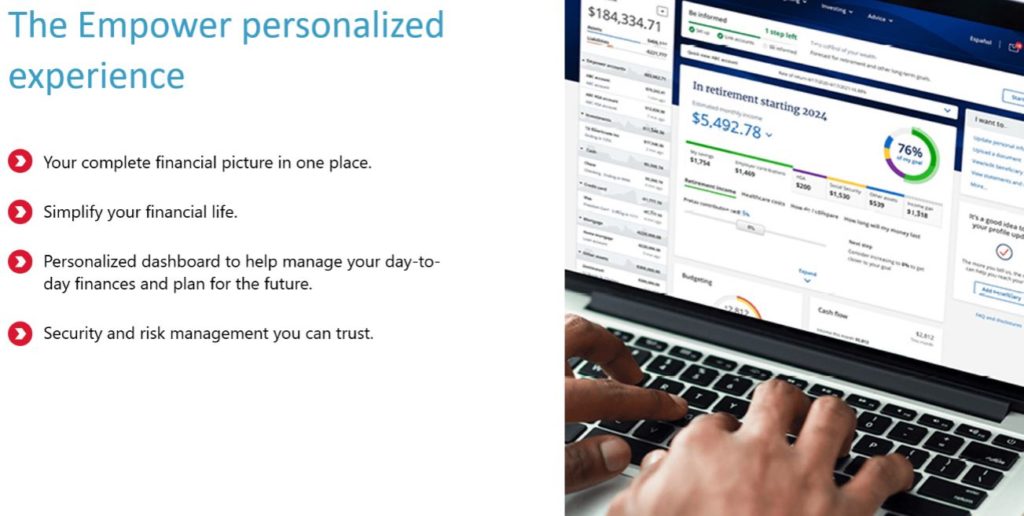

Click on the image below to watch a short video on how Empower Retirement personalizes your retirement experience.