Flexible Spending Account (FSA)

Inframark partners with MyChoice® Accounts to provide you the opportunity to contribute tax-free dollars from your pay into a Healthcare and/ or Dependent Care Flexible Spending Account (FSA). Since the money you contribute to your FSA is tax-free, your taxable income is then reduced. It is important to remember that FSAs have a “use-it-or-lose-it” rule, so plan accordingly!

If you have questions or concerns, please call the Online Benefits Service Center at 888-532-3617, available Monday – Friday, 9am – 6pm EST.

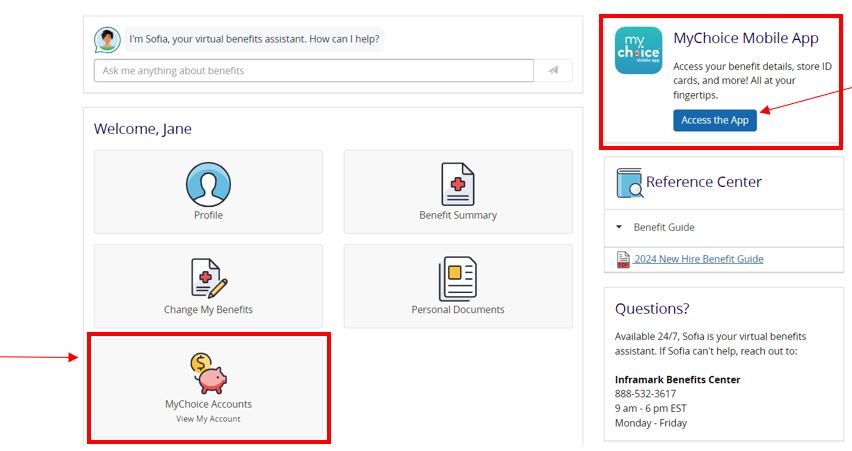

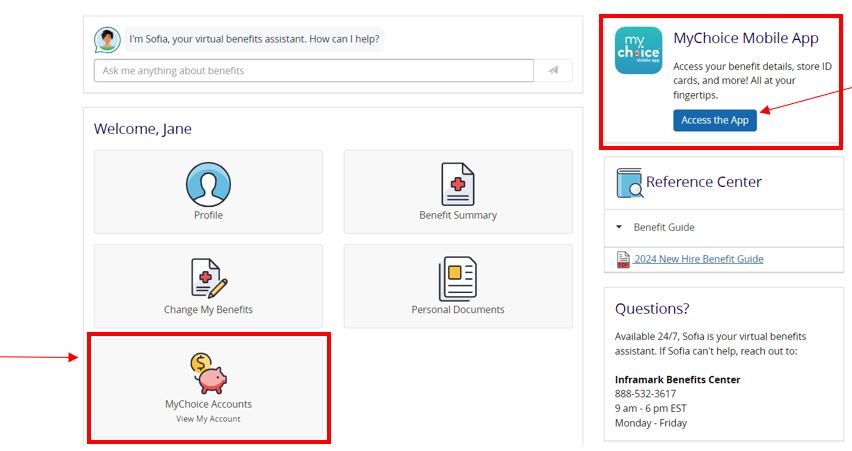

Access or Manage your FSA Account/s Online or Mobile App.:

- Log into your Inframark Online Benefits Center (new users must register first).

- If you need assistance registering or logging in, please call the Online Benefits Service Center at 888-532-3617, available Monday – Friday, 9am – 6pm EST or 8am – 5pm CST.

- After you have logged in successfully. Scroll down your member home page and click on “MyChoice Accounts”.

- Don’t Forget! Click on the “Access the App” button to download the mobile app so you can manage your FSA from anywhere!

Healthcare FSA

Let’s you contribute up to $3,300 (for 2025) in annual pre-tax dollars to pay for eligible healthcare expenses. Although the health care FSA is a use-it-or-lose-it account, you can rollover up to $660 of unused funds to use into the next calendar year for 2026.

- General Purpose FSA – if you enroll in one of the PPO medical plans, you may enroll in General Purpose FSA. Use your account to pay for medical, prescription, over-the-counter, dental, and visions expenses.

- Limited Purpose Healthcare FSA (HDHP members only) – if you are enrolled in the High Deductible Health Plan (HDHP) with a Health Savings Account (HSA), you can use your Limited Purpose Healthcare FSA for eligible dental and vision care expenses only. Due to federal guidelines concerning HSAs, participants are not eligible to enroll in a General Purpose Healthcare FSA in conjunction with their HSA.

You may use your MyChoice® FSA Account money on expenses for yourself, your spouse, or your federally eligible dependent children up to age 26, regardless of if you or they are participating in any other benefit plan. You must actively enroll each year to participate in the FSA benefit.

Key Features:

- Tax-free money: Money goes in tax-free and comes out tax-free when used for eligible expenses.

- Convenient payroll deductions: Contribute to your accounts easily and effortlessly.

- Helpful budgeting tool: Plan for future expenses by setting aside money each paycheck.

For a complete list of eligible items and services, visit https://fsastore.com/fsa-eligibility-list.

Dependent Care FSA

Let’s you contribute up to $5,000, or $2,500 if both you and your spouse elect the benefit, and you file your taxes separately. Only services that allow you and your spouse (if married) to work full-time, attend school on a full-time basis or seek full-time employment are eligible for reimbursement. Generally, expenses will qualify for reimbursement if they are the result of care for:

- Your children, under the age of 13, for whom you are entitled to a personal exemption on your federal income tax return.

- Your spouse or other dependents, including parents, who are physically or mentally incapable of self-care.

- Click here to see the perks of opening a Dependent Care FSA!